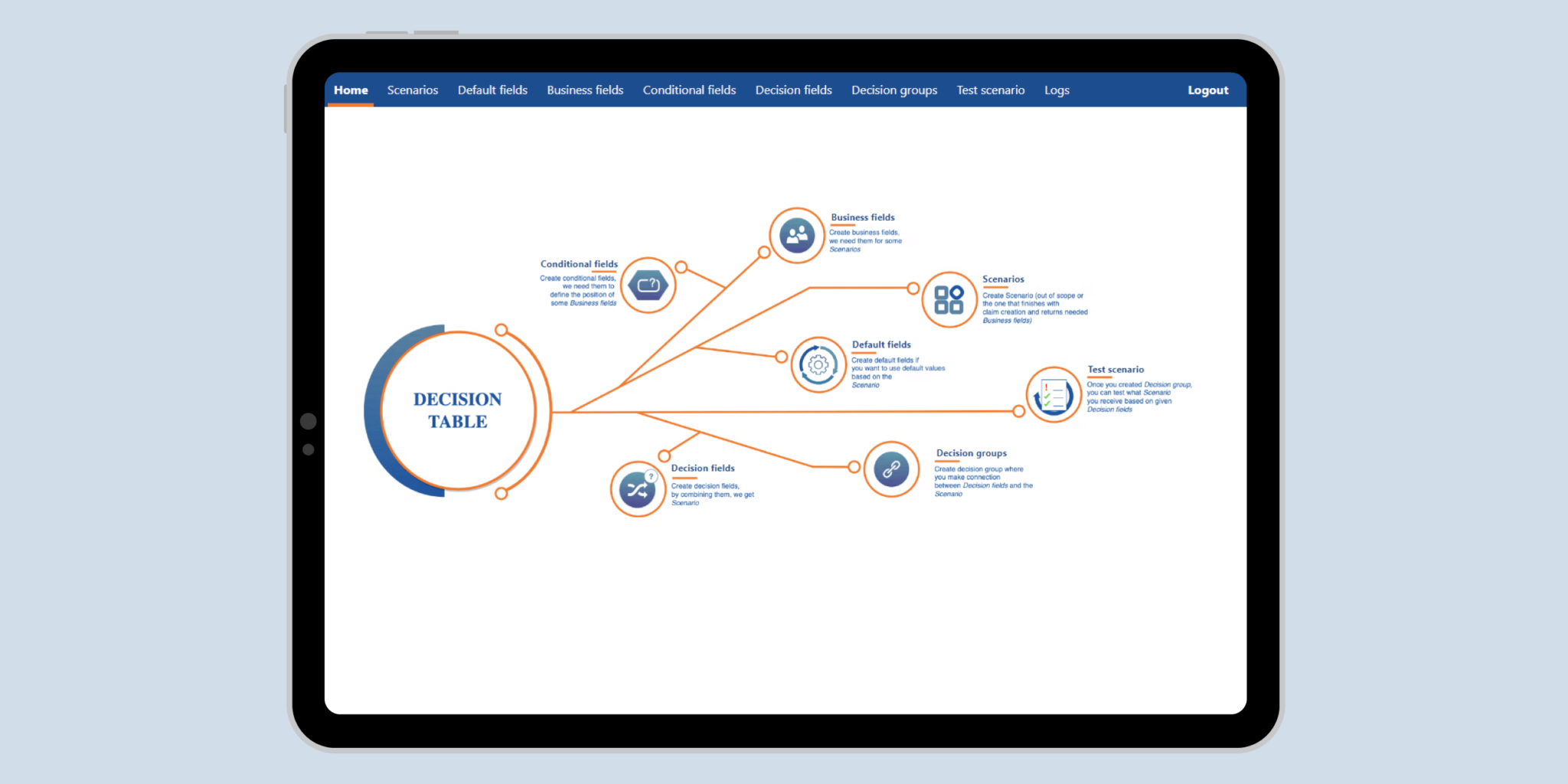

The solution introduces a Decision Table that standardizes and interprets claims from different brokers, enabling automated processing and reducing manual input.

Client name Vivium

Industry Insurance

Technology Java, Spring boot, React, MuleSoft

Location Antwerp, Belgium

Team size 4

Project duration 2 years – ongoing

The Vivium company (part of the P&V Group) is among the top 3 insurance providers in Belgium. They offer insurance packages to more than 1000 independent insurance brokers. Their clients (brokers) work as mediators between insurance companies and end customers.

When brokers submitted claim declarations, they couldn’t complete the entire process digitally. While they could provide general information through the online system, the subsequent steps required a lot of manual handling by Vivium employees. The absence of a standardized method for decoding each broker’s unique standards and message codes further complicated the process, causing delays and inefficiencies.

Enabling the submission of claims through APIs

Flexibility and the ability to onboard multiple consumers

Developing a method to interpret different codes and standardize messages from brokers

Synchronizing the manual and digital processes into one solution

To address the challenge of interpreting different brokers’ codes, a middle component called a Decision Table was implemented. When brokers submit a claim, the Decision table selects from over 30 main scenarios and 500 variations. The selected scenario guides the back office on how to process the claim, even if some data is pending. Default fields and automated API integrations further streamline the process, reducing the need for manual input from brokers. The decision table also enables the client to create and manage new scenarios independently.

The client can now fully process claim declarations from different brokers

The new solution minimalizes the need for manual work, enabling faster processing and reducing the risk of human error

The system is designed for scalability, allowing for flexible adaptation and onboarding of multiple consumers

The client can create new scenarios and add rules for them without requiring IT support

Chief Product Owner

Insurance Company