Our custom built-in solution uses Experience APIs to facilitate integration with insurtechs, enabling brokers to generate quotes more efficiently. The Developer Portal we implemented provides tools for API monitoring, content management, and issue reporting.

Client name Vivium

Industry Insurance

Technology Java, Spring boot, React, MuleSoft

Location Antwerp, Belgium

Team size 5

Project duration 3 years – ongoing

The Vivium company (part of the P&V Group) is among the top 3 insurance providers in Belgium. They offer insurance packages to more than 1000 independent insurance brokers. Their clients (brokers) work as mediators between insurance companies and end customers. They collect data from all insurers through insurtech platforms to provide the best possible insurance policy for their clients.

Vivium used System APIs which were robust and required a lot of data to function properly. As a result, brokers had to fill in excessive information when requesting a quote through insurtechs.

Developing a custom built-in solution easily integrated into insurtech platforms, with all the necessary documentation to support a seamless implementation

Ensuring the new APIs are compatible with both legacy systems and modern core systems

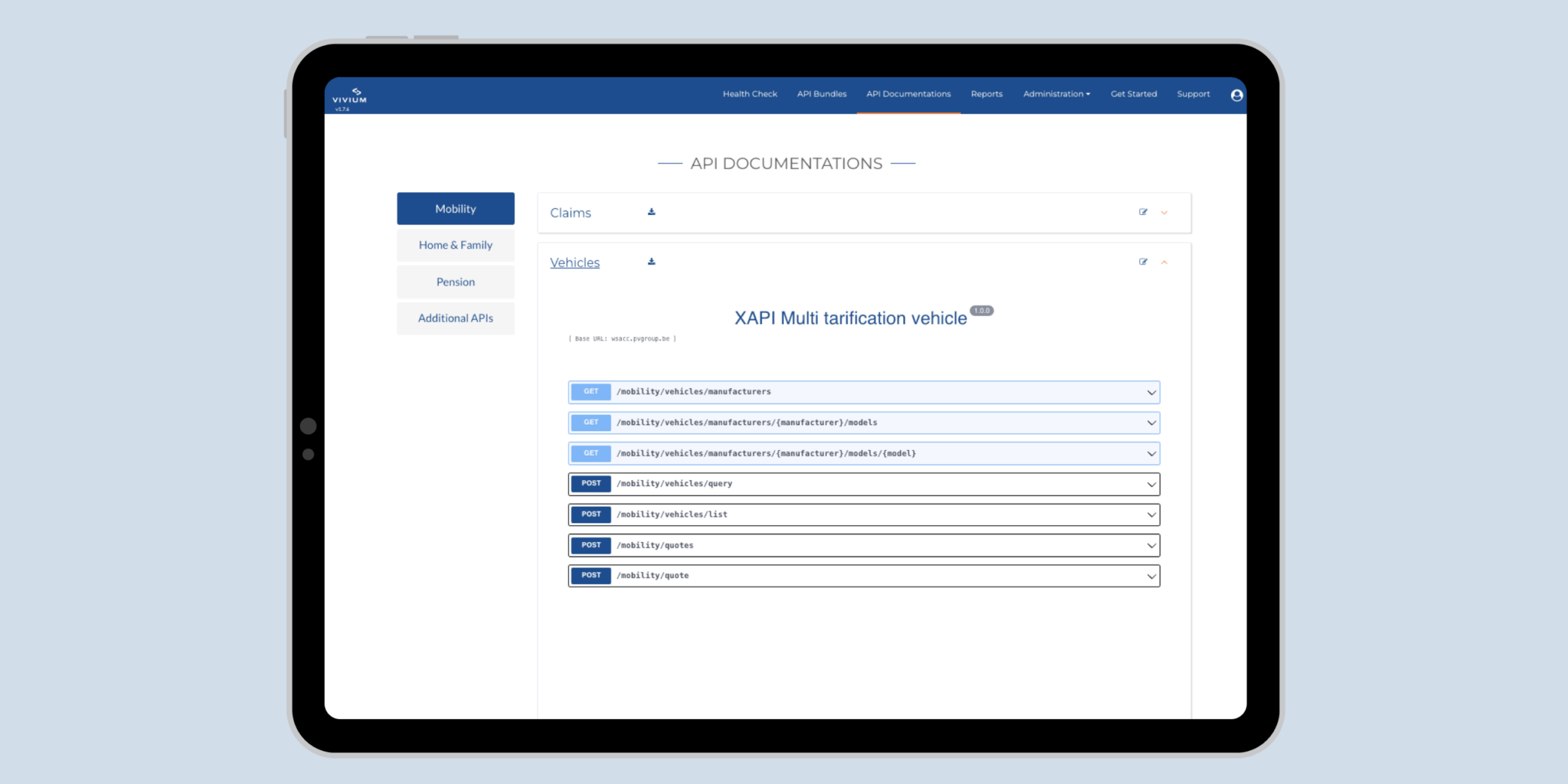

Also, the Developer Portal was developed, accessible by both Vivium’s admins and brokers, it facilitates integration with brokers’ platforms and content management.

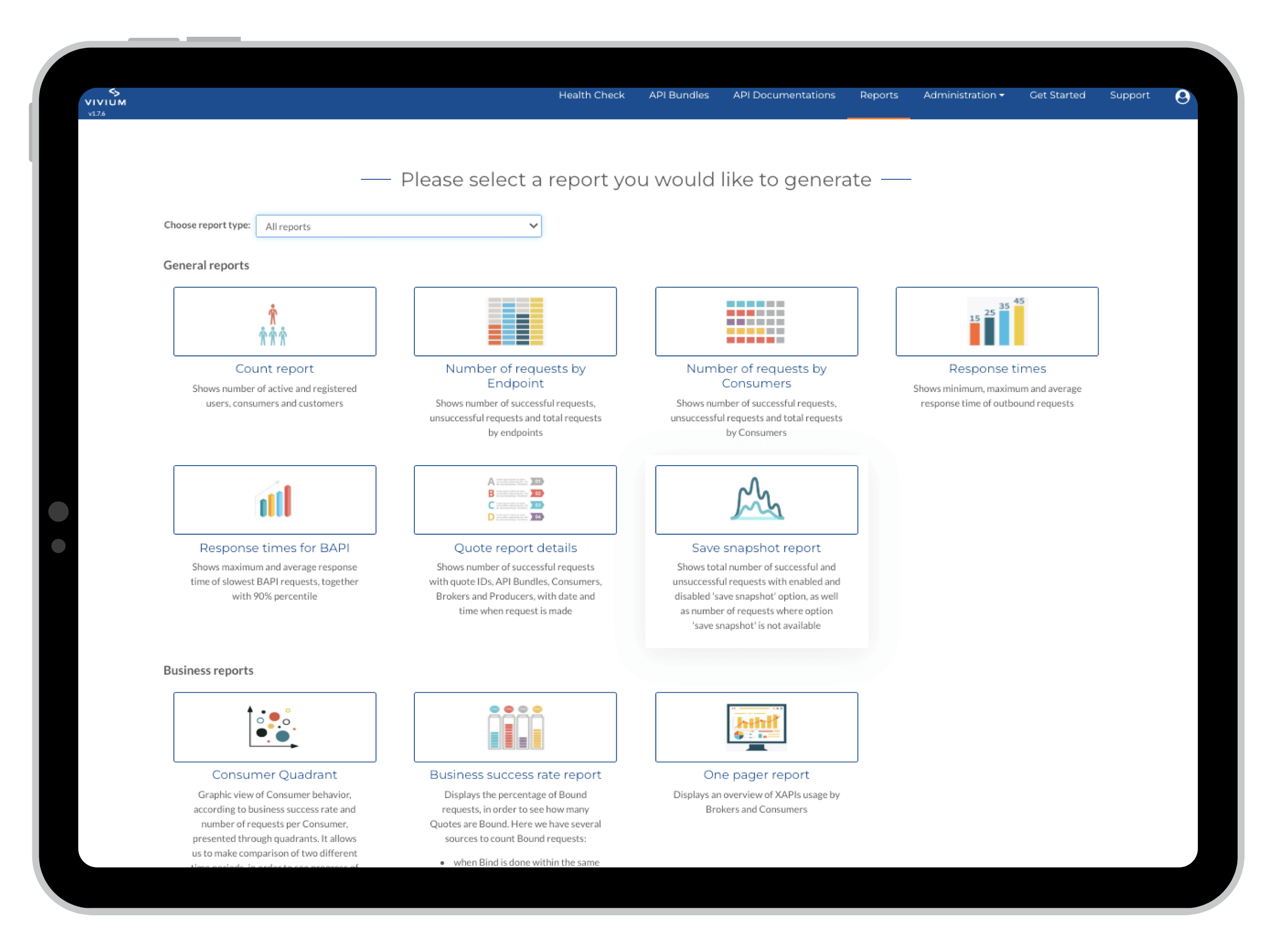

Using the Developer Portal, Vivium admins can access detailed statistics on Experience API usage, including the number of requests made by brokers, response times, peak query days, and the most frequent times of day for queries. They can also track the number of quotes bound and the success rate for each broker.

For managing FAQs, the portal includes a feature that allows admins to make and view content changes easily. Additionally, there is an announcements section where admins can post news and, if needed, target specific groups of users.

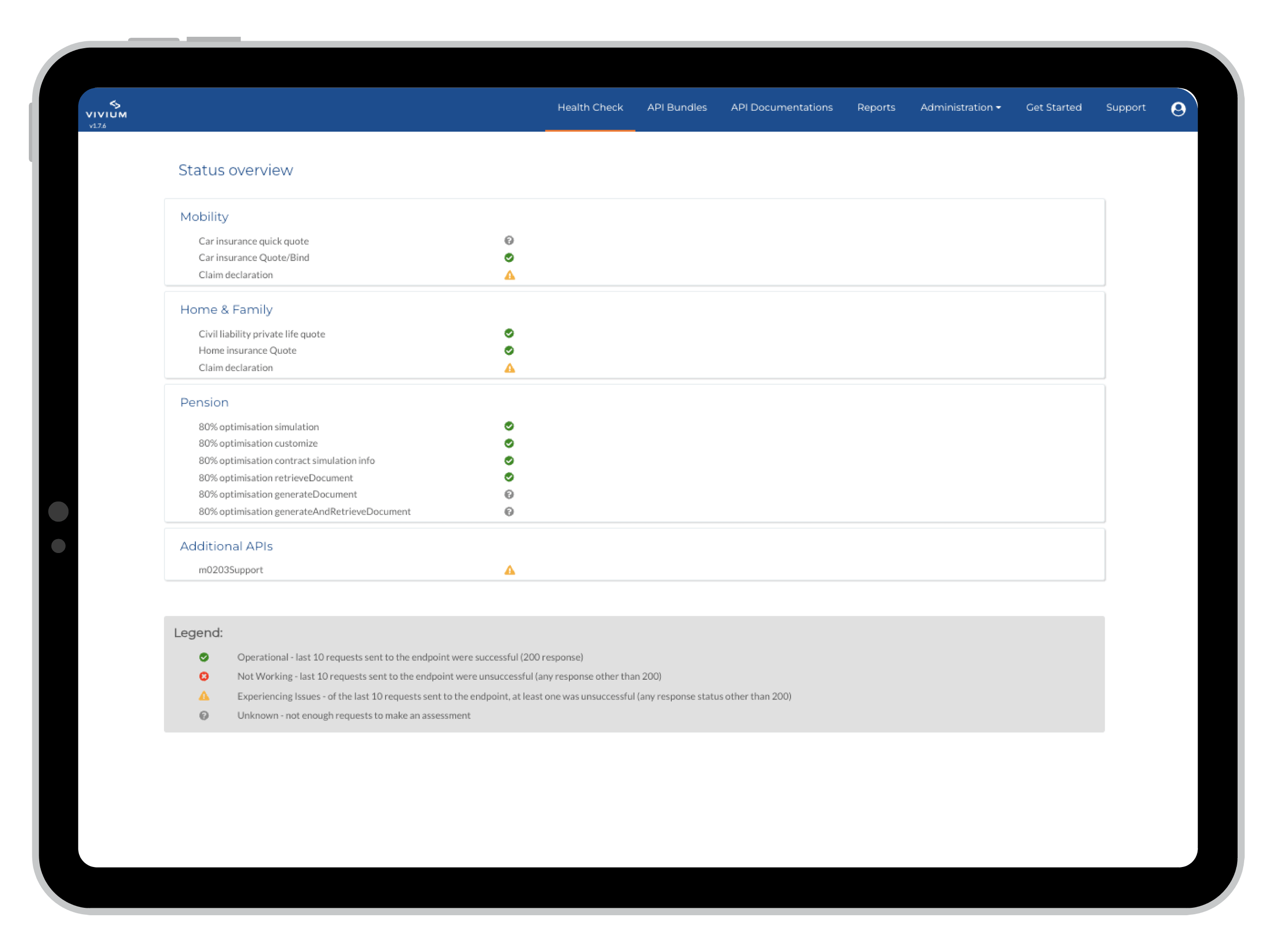

Brokers can also access the Developer portal for API health check monitoring. They can check if an API is down or having issues and report those problems directly in-app. Additionally, they can explore other available Experience APIs and apply for access to them.

One endpoint per customer, additional simplifications in a request for the end user, flexibility, and innovation are all advantages of using Experience APIs. For the back end, we used Java and the Spring boot framework, while for the front end and API orchestration, we used React and MuleSoft Anypoint.

The main benefit for the client was quality APIs that are flexible and easily integrated with insurtechs

Using personalized APIs for each broker gives our clients a better NPS score which represents the likelihood that a broker would recommend them

Vivium managers can now follow quotes from request to finalization. This helps in monitoring queries, detecting potential issues brokers may encounter with API requests, and identifying which brokers finalize contracts with end users most frequently

Chief Product Owner

Insurance Company