This custom web app allows P&V clients to effortlessly register claims and enables P&V employees to track, manage, and streamline payment requests.

Client name Group P&V

Industry Insurance

Technology Java, Spring Boot, Angular

Location Brussels, Belgium

Team size 4

Project duration 5 years

The P&V Group is a Belgian cooperative insurance group that offers insurance solutions to individuals, self-employed workers, companies, and institutions.

Some P&V business clients report workplace accidents as part of their insurance packages. However, P&V’s system for registering work accidents was entirely manual. It involved lengthy and complex prompts that had to be manually completed, approved, and then sent for payment.

Fully transitioning from manual to digital with a new platform for work accident registration

The solution had to be integrated with the client’s legacy systems

Adaptable to legal changes while maintaining the core characteristics of accident registration documentation

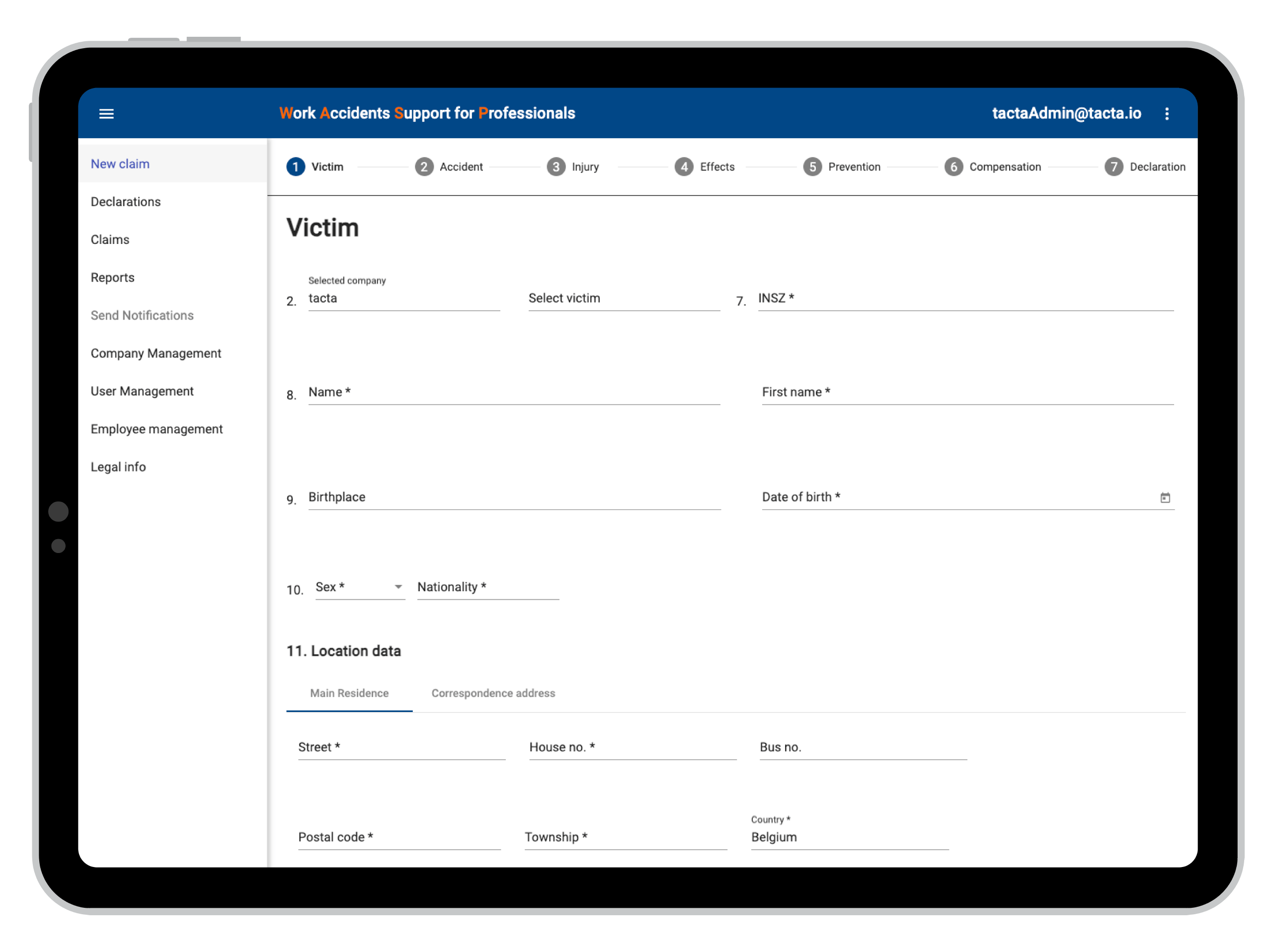

P&V clients can access the platform to report work accidents and file insurance claims. They can select the type of insurance, work accident, and other important parameters to create a claim, with the option to save drafts and complete them later. Meanwhile, P&V employees can view and manage claim requests, and if approved, send payment requests to external providers.

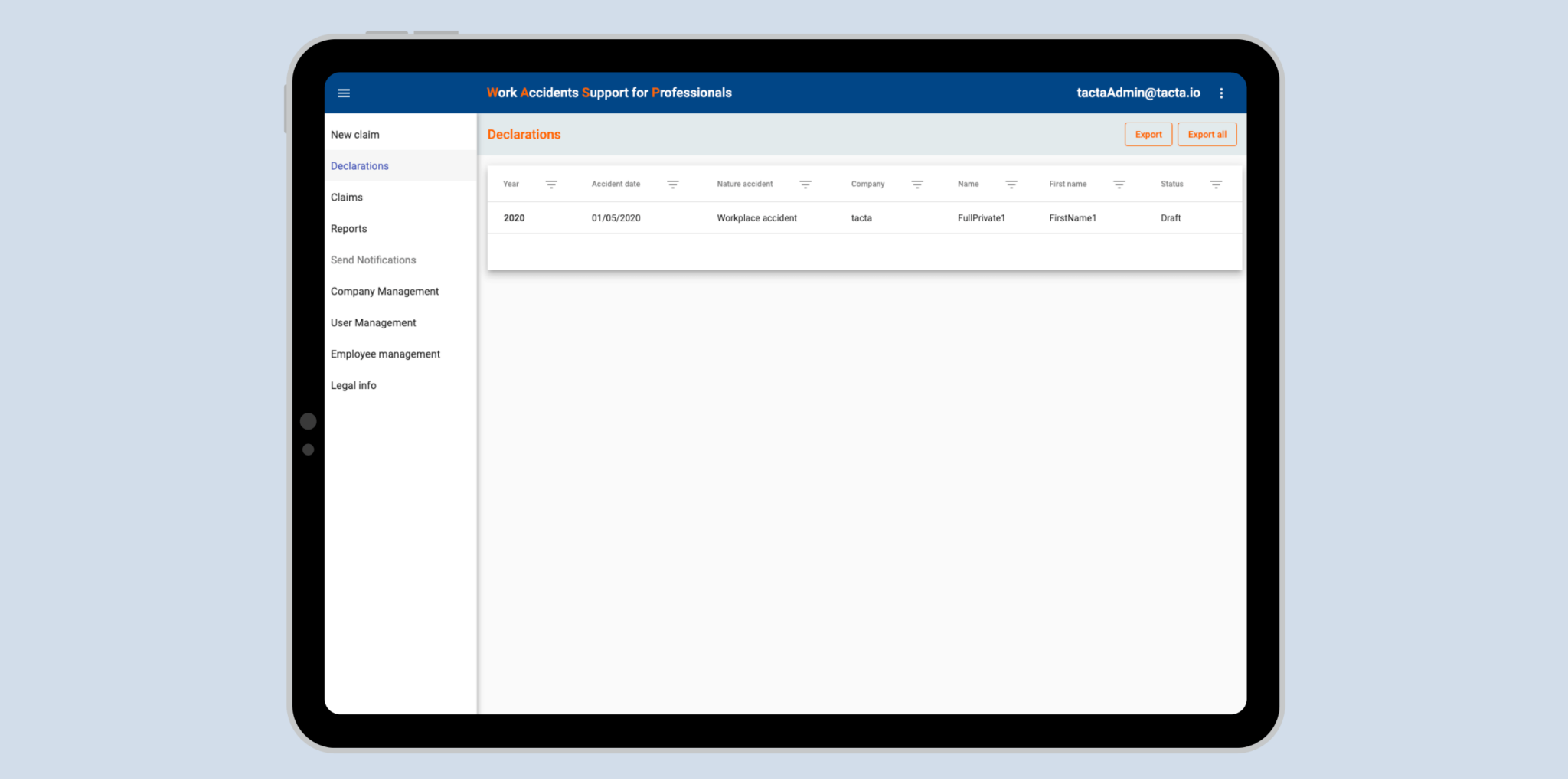

Authorized P&V employees can track the progress of accident claims from submission to approval and payment. For an improved user experience, status codes related to various claim stages have been introduced. P&V employees can now easily approve or disapprove claims directly within the app.

The reporting tool provides P&V employees with a comprehensive overview of all accident reports. The advanced filtering options allow them to generate detailed statistics by company, claim number, type, and time.

For the development of the web app, we opted for Java and the Spring Boot Framework. The solution was fully integrated into the P&V ecosystem – including a SAML SSO integration with the company’s Identity provider services. For front-end development we used a combination of Angular with the latest Angular Material library, visually adapted to match the client’s visual identity.

The complete digitalization and automatization of their accident-claiming processes

They can now easily handle a large number of claims and follow them up in real-time

The extensive reporting tool can be useful for future prevention analysis for employers